How to Get an India PAN Card as a Foreigner or NRI

If you need to open a bank account, invest, or handle tax matters in India, you will almost

always be asked for an India PAN Card (Permanent Account Number).

Whether you are an NRI (Non-Resident Indian), an OCI / PIO cardholder,

or a foreigner doing business in India, having a valid PAN card is essential for smooth

financial and legal transactions.

This guide explains what an India PAN card is, who needs it, how to apply online, and how

Hague Apostille Services can help with translations, notarization, and apostille for your

Indian documents when they are needed abroad.

What Is an India PAN Card?

A PAN card is a 10-digit alphanumeric ID issued by the Income Tax Department of India.

It works as a unique tax identification number for individuals and entities.

The official information and online application options can also be found on:

Who Needs an India PAN Card?

In general, you should apply for an India PAN card if you:

- Live and work in India as a resident or foreign national

- Are an NRI with income or investments in India

- Hold OCI / PIO status and need to manage property or banking in India

- Run a business, open a branch office, or freelance in India

- Need to file Indian income tax returns or receive tax refunds

Why Is an India PAN Card Important?

A valid PAN card is required for many everyday and high-value transactions in India, including:

- Opening and maintaining an Indian bank account

- Receiving salary or professional fees in India

- Buying or selling property and vehicles

- Investing in stocks, mutual funds, and insurance products

- Paying taxes and claiming tax refunds

- Complying with KYC (Know Your Customer) requirements

Basic Documents Required for an India PAN Card

Exact requirements can vary slightly depending on your status (resident, NRI, OCI, foreign national),

but in most cases you will need:

- Passport (mandatory for foreigners and NRIs)

- Proof of address (passport address page or local address in India)

- Recent passport-style photograph for the card

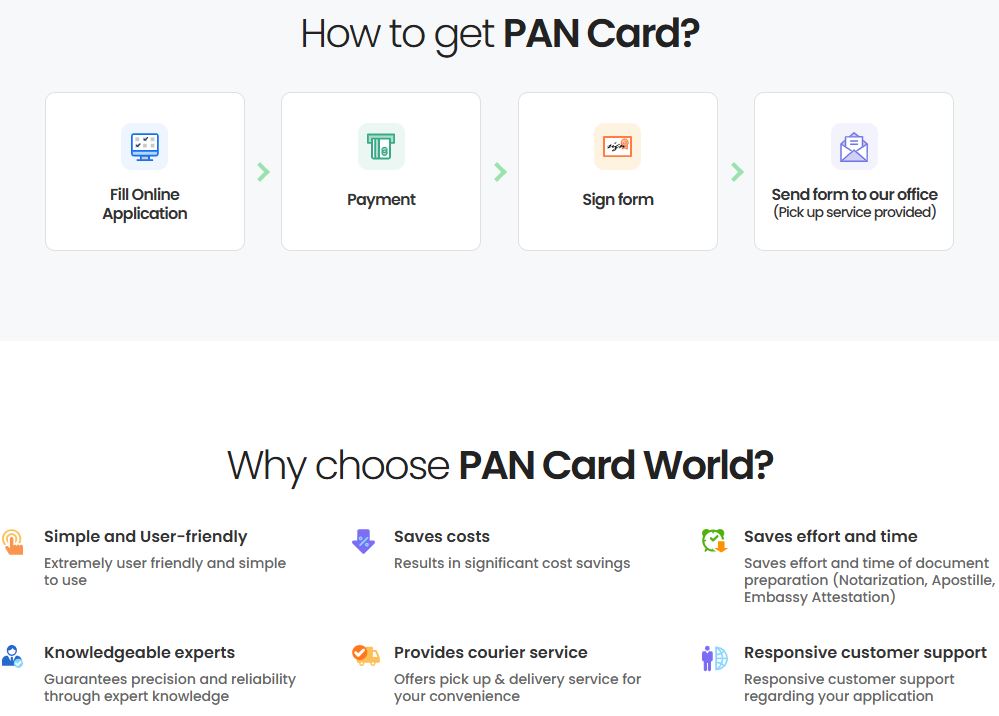

How to Apply Online for an India PAN Card

- Fill out the PAN application form online.

You can apply through portals mentioned on

pancard.world

or through authorized service providers. - Upload your documents.

Scan and upload your passport, proof of address, and photo according to the file format and size required. - Pay the government and service fees.

Fees can vary based on whether the PAN card is delivered inside or outside India. - Wait for verification.

The Income Tax Department checks your information and documents. - Receive your PAN number and e-PAN.

In many cases, a digital copy (e-PAN) is issued first, followed by the physical PAN card by mail.

Processing Time for an India PAN Card

For most applicants, the e-PAN is issued within about

7–15 business days after successful submission and payment.

The physical PAN card may take longer to reach your address, especially if it needs to be

delivered outside India.

Do You Need Apostille or Legalization for Your India PAN Card?

Some foreign authorities, immigration offices, banks, or universities may ask for

apostilled or legalized copies of your Indian documents, including:

- India PAN card

- Indian bank statements and tax certificates

- Indian birth, marriage, or educational documents

In those cases, your Indian document often needs to be:

- Translated into the required language (if requested)

- Notarized or certified by the proper authority

- Apostilled under the Hague Apostille Convention or fully legalized through an embassy or consulate

How Hague Apostille Services Can Help

Hague Apostille Services assists clients worldwide with:

- Professional translation of India PAN cards and other Indian documents

- Notarization and certification coordination, where applicable

- Apostille and consular legalization for use in foreign countries

- Guidance on document requirements for immigration, study, work, and banking

If you already have your India PAN card and need it to be recognized in another country,

contact us to discuss the best combination of translation, notarization, apostille, and legalization

for your specific situation.

Frequently Asked Questions about India PAN Cards

1. Can a foreigner apply for an India PAN card?

Yes. Foreign nationals who earn income in India, invest in India, or need to open a bank account in India

can apply for a PAN card using their passport and other supporting documents.

2. Do NRIs need a PAN card for investments in India?

In most cases, NRIs need a PAN card to invest in Indian stocks, mutual funds, real estate,

or other financial products, and to file Indian tax returns if required.

3. How long does it take to get an India PAN card?

Processing times can vary, but many applicants receive their e-PAN within about 1–2 weeks

after submitting a complete application and payment.

4. Can Hague Apostille Services help with apostille for PAN and other Indian documents?

Hague Apostille Services can guide you through the steps required to prepare your Indian documents –

including PAN cards, tax certificates, and educational records – for use overseas through

translation, notarization, apostille, and consular legalization where needed.

Need help with India PAN card–related documents, apostille, or legalization?

Reach out to Hague Apostille Services and get step-by-step support from start to finish.